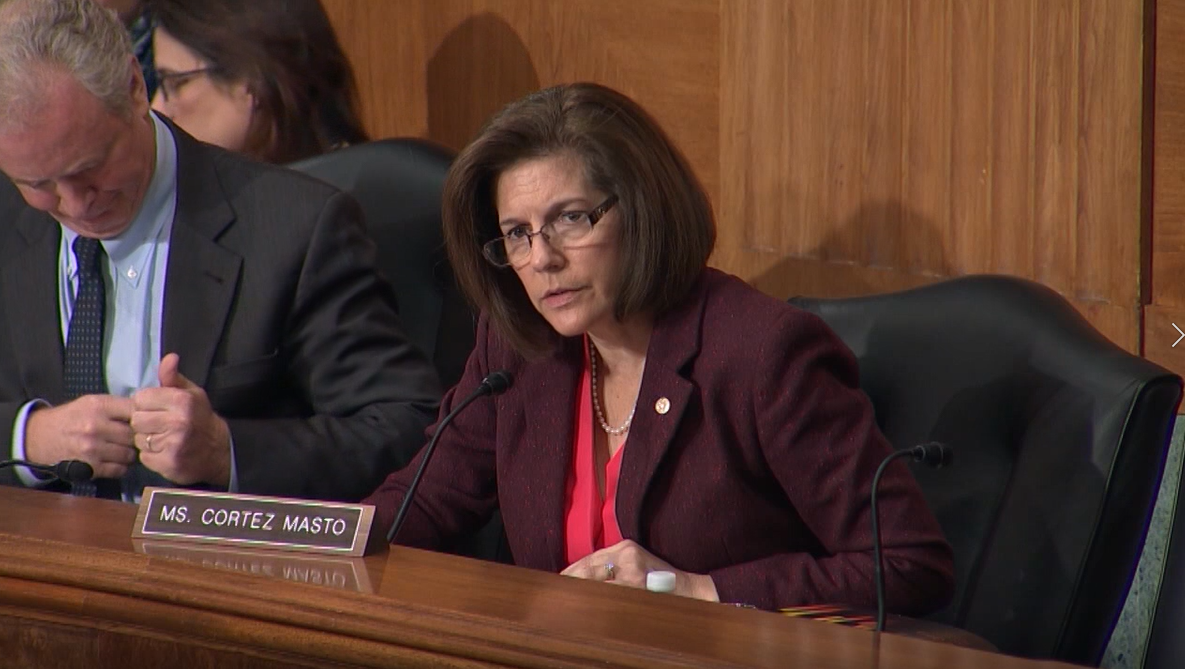

Washington, D.C. – In a hearing of the Senate Banking, Housing, and Urban Affairs Committee, U.S. Senator Catherine Cortez Masto (D-Nev.) questioned U.S. Securities and Exchange Commission (SEC) Chairman Jay Clayton about a proposed rule to protect investors from investment firms and broker-dealers with a history of misconduct.

Last month, Senator Cortez Masto led five of her Democratic colleagues in a letter urging the Financial Industry Regulatory Authority (FINRA) to provide strong investor protections in its final Rule 4111, known as the “bad broker” rule. In the letter, the senators expressed concern that the proposed Rule 4111 will allow bad actors to continue to defraud and mislead investors because, among other things, it fails to publicly identify them, allows them to avoid paying settlements, and allows them to easily expunge their records.

“I also appreciate your attention to preventing retail investors from falling victim to fraud. FINRA has proposed a rule to make it more difficult for dishonest brokers and their firms to operate. Again, last month, along with my colleagues, we sent a letter to FINRA asking them to strengthen this proposed Rule 4111 to expel firms and brokers with a history of fraud. I know FINRA is finalizing this rule now. My understanding is [that] it’s going to be passed to the SEC for you to take a look at,” explained Senator Cortez Masto at today’s hearing.

She continued, “I guess my question is, just, will you ensure that Rule 4111 is clear that unscrupulous financial professionals cannot continue to operate? And then secondly, when will the SEC approve, or when do you anticipate taking a look at that rule and approving it, or having a comment with respect to 4111?”

“Let me say, generally, our view is [that] it’s a privilege to work in our securities markets. It’s a privilege that you can lose and should lose if you misbehave. I want to be careful not to prejudge; I haven’t seen the text of the rule. What I will say, I have long been supportive of the concepts that are in that rule, including that principle. Let’s put it this way: if you’re going to hire somebody who has a history, the registration and other requirements that FINRA imposes should reflect that you’re taking more risk than someone who doesn’t,” responded Clayton.

Full video of this exchange is available here.