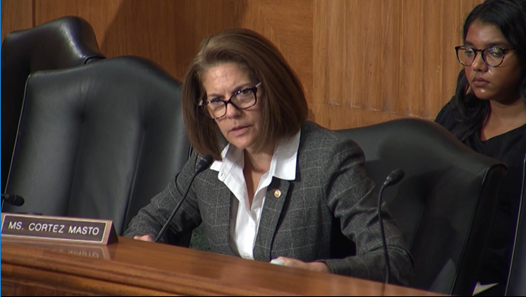

Washington, D.C. – At a Senate Banking Committee hearing on the challenges of cannabis banking, Senator Catherine Cortez Masto (D-Nev.) discussed the need to ensure legal cannabis businesses have access to banking services and the security those services bring. She highlighted the importance of passing the Secure And Fair Enforcement (SAFE) Banking Act, which would allow banks and credit unions to provide financial services to licensed cannabis businesses, cannabis-related businesses and service providers in states that have legalized medicinal or recreational marijuana use.

Senator Cortez Masto began her questioning by outlining the support for the SAFE Banking Act, and highlighted an endorsement from 38 state and territory Attorneys General, including the current Attorney General of Nevada. She continued by detailing the far reaching impacts the unbanked cannabis industry is currently having in Nevada, and across the country, and stressed the need for more regulation and oversight.

“I know the people of the State of Nevada voted, as a majority, to go down this path [of legalizing recreational marijuana use], and I respect that. As a former Attorney General, I do think there is concern because we don’t have a financial system. These businesses are forced to operate on a cash basis. In their letter, the AGs said that ‘the resulting grey market makes it more difficult to tax revenues for taxation and regulatory compliance purposes, contributes to a public safety threat as cash intensive businesses are often targets for criminal activity, and prevents proper tracking of billions in finances across the nation’. We need to address this issue for those very reasons,” said Cortez Masto.

She continued by questioning Ms. Rachel Pross, Chief Risk Officer for Maps Credit Union, about the risks of a cash-based cannabis industry, stating that “one in every two cannabis dispensaries were robbed or burglarized with the average thief walking away with anywhere from $20,000 to $50,000 in a single theft. Outside of burglary and theft, can you discuss what other risks are associated with an unbanked industry that in my state generated more than $600 million in revenue last year?”

Ms. Pross replied, “As a Bank Secrecy Act expert, my concerns are financial activity going outside state lines, money laundering, financial crime, the financing of revenue for cartels or gangs. Having the money going through a legitimate and transparent financial institution relationship allows us to hone in on activity that could indicate financial crime, and it is promptly reported. It also helps us ensure that the activity going through our credit union is above board.”

“And we’ve been talking about not only the banking system, but also about legitimate medical marijuana businesses, but we haven’t talked about the ancillary businesses. As you know, there are so many other companies that are doing legitimate business with these establishments, from the security companies, the landlords, accountants, electricians, garden stores. They’re also affected by a lack of a financial system to engage in, is that correct?” said the Senator.

“Yes it is,” Ms. Pross replied.

Video from the hearing is available for download here.

###