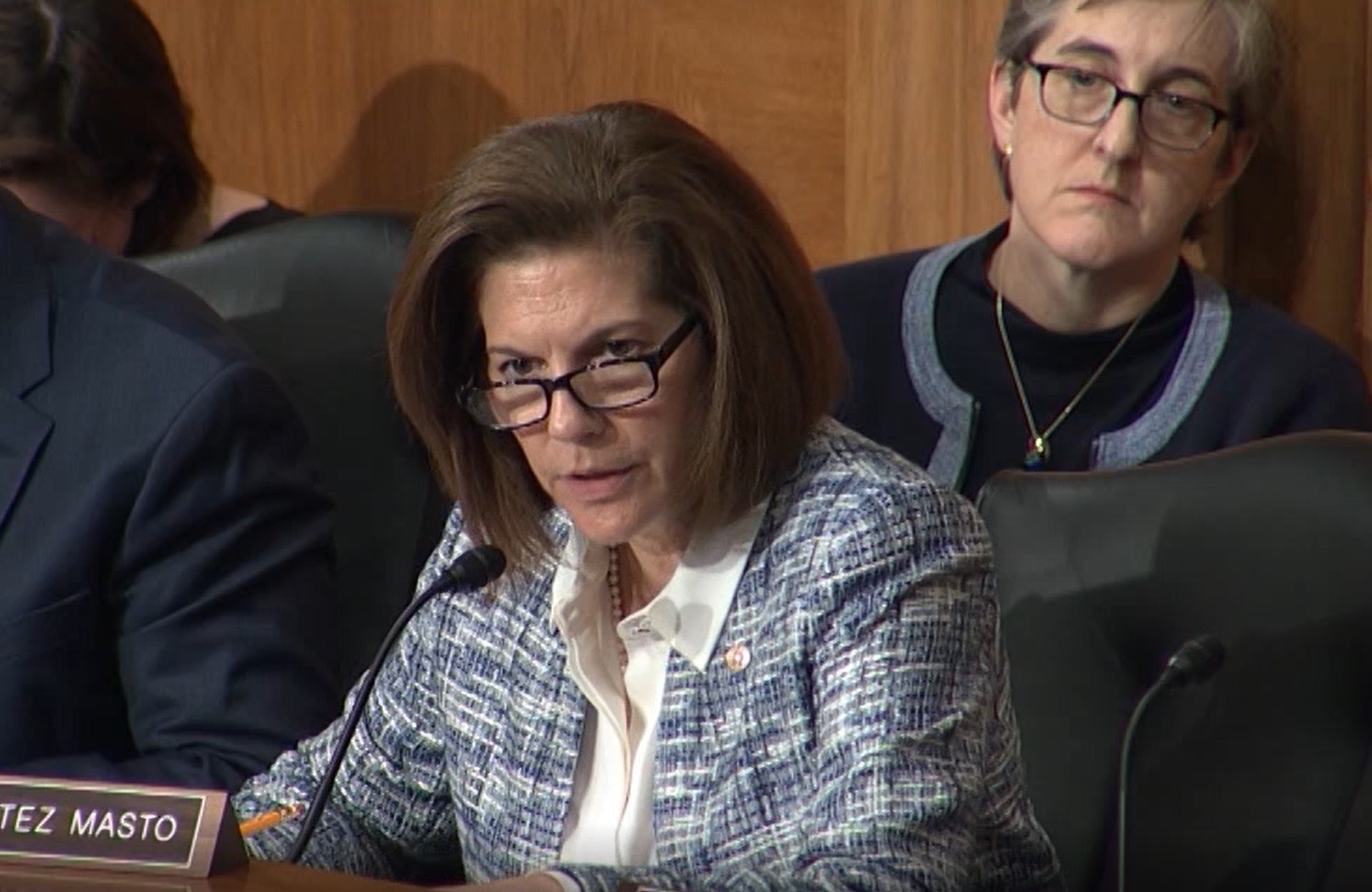

Washington, D.C. – As many American workers face financial uncertainty due to the coronavirus outbreak, U.S. Senator Catherine Cortez Masto (D-Nev.) questioned Consumer Financial Protection Bureau (CFPB) Director Kathy Kraninger about the CFPB’s efforts to roll back commonsense protections for small-dollar borrowers. The senator pressed Kraninger about the CFPB’s lack of enforcement against predatory lenders and asked if the Bureau was proceeding with plans to rescind existing small-dollar lending rules.

“Many of us are worried that predatory online lenders will step up their efforts to target vulnerable – and financially vulnerable – struggling families with expensive loans during this coronavirus crisis. Critics of your decision to weaken the Consumer Bureau’s 2017 small-dollar lending rules say that lenders no longer have to verify a borrower’s income, debt, and spending habits to assess their borrowing threshold before underwriting their loan. Do you agree with that?” asked the senator.

Instead of acknowledging that she suspended the 2017 payday rule that was supposed to protect consumers, Kraninger threw out a red herring and blamed the suspension of that rule on a lawsuit. What Kraninger did not say is that the Mulvaney-led CFPB and the payday lender plaintiffs jointly requested that the court pause the litigation because the dispute could be resolved by a new rulemaking that would repeal the 2017 payday rule.

The senator further inquired into why Kraninger was so hostile to including a commonsense requirement that a consumer be able to repay a loan. She also inquired into why Director Kraninger had voted for an FDIC rule that would enable online payday lenders to make loans that are illegal under state law. Finally, she demanded the Consumer Bureau resume supervision for student lending and stand up to the Education Secretary Betsy DeVos, who has prevented the Bureau from performing its important oversight role.

Full video of this exchange is available here.