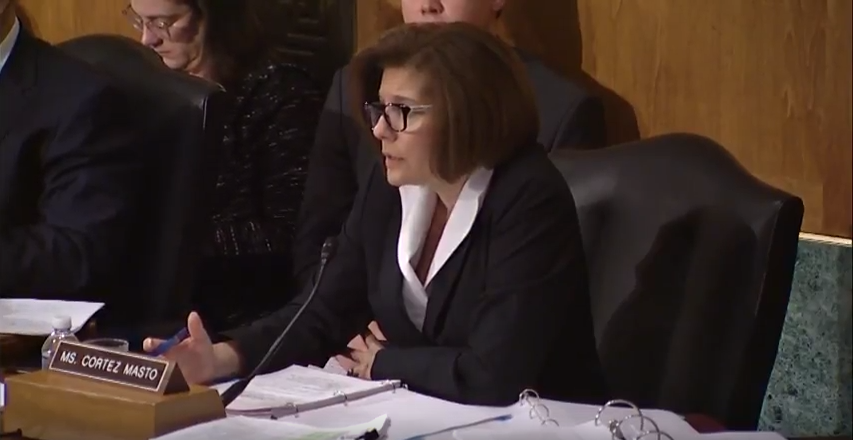

Washington, D.C. – During a U.S. Senate Committee on Banking, Housing, and Urban Affairs markup on a bill to roll back major provisions in the Wall Street Reform and Consumer Protection Act, U.S. Senator Catherine Cortez Masto (D-Nev.), a member of the Committee, proposed six amendments to empower consumers and protect taxpayers from bank bailouts.

Cortez Masto Amendment 70 ensured that borrowers would be able to take their bank to court. By reinstating a rule from the Consumer Financial Protection Bureau (CFPB) repealed by Congressional Republicans in October, this amendment would have disallowed companies like Wells Fargo or Equifax from burying consumers in fine print that blocked their access to court.

In an exchange with U.S. Senator Mike Rounds (R-S.D.), Senator Cortez Masto exposed Republicans’ hypocrisy regarding their latest effort to eviscerate the Wall Street Reform and Consumer Protection Act. In his response to Senator Cortez Masto’s proposed amendment, Senator Rounds rejects it on the grounds that “Congress and the President have already spoken on the issue of pre-dispute arbitration agreements by repealing the CFPB’s flawed rule prohibiting pre-dispute class action waivers in arbitration agreements this last October.”

However, Senator Cortez Masto identifies the irony in his statement, “I appreciate my colleague’s comments, but if Congress has already responded and this White House has responded, if that were true, then why are we looking to roll back the regulations in Dodd-Frank because Congress has already spoken?”

In addition to Amendment 70, Senator Cortez Masto also proposed the following amendments:

|

Amendment 69 |

Reverse Mortgage Protections For Seniors:

|

|

Amendment 71 |

Maintaining Stress Tests For Banks That Have Failed:

|

|

Amendment 72 |

Barring Regulatory Relief For Banks That Defrauded Homeowners:

|

|

Amendment 73 |

Strengthening Protections To Prevent Housing Discrimination:

|

|

Amendment 75 |

Prohibiting Regulatory Relief Until All Wall Street Reform Rules Have Been Finished:

|

###